The commercial real estate crisis presents a formidable challenge in today’s economy, threatening financial stability as high office vacancy rates and rising banking sector risks collide. The demand for office spaces has plummeted post-pandemic, leading to a troubling increase in vacancy rates that hover between 12% to 23% in major cities across the U.S. This downturn is notably compounded by the impending wave of real estate loans that are set to come due by 2025, stirring apprehension among economic experts regarding potential bank losses. With the Federal Reserve reluctant to lower interest rates, the economic impact of falling property values is becoming increasingly tangible. As investors brace for a possible surge in delinquencies, the repercussions could ripple through the banking sector, amplifying concerns over financial pressures and economic resilience.

The ongoing issues in the commercial property market signify a deeper economic concern that has been described as a real estate recession. As vacancy rates for office spaces soar and the borrowing landscape shifts, many industry analysts question the resilience of lenders and their portfolios. Reports suggest that the pressures from an influx of commercial mortgage debts nearing maturity may culminate in a series of financial challenges for smaller banks, as they face mounting pressures from their investment in real estate. Additionally, the reluctance of the Federal Reserve to adjust interest rates, despite the soaring vacancy rates in urban office buildings, is creating an environment ripe for economic turbulence. This complex interplay of factors underscores the urgency for stakeholders across the financial landscape to navigate the impending crisis effectively.

Understanding the Commercial Real Estate Crisis

The commercial real estate crisis currently unfolding is primarily driven by a combination of high office vacancy rates and a surge of real estate loans set to mature by 2025. Major U.S. cities are experiencing vacancy rates ranging from 12% to as high as 23%, resulting in significant declines in property values. This scenario raises alarms among financial experts about the potential for substantial losses in the banking sector, particularly concerning commercial loans. With twenty percent of the total $4.7 trillion in commercial mortgage debt coming due this year, the implications for economic stability are severe. The ripple effects of declining property values could adversely affect the broader economy and lead to a tightening of credit as banks grapple with increased risks in their real estate portfolios.

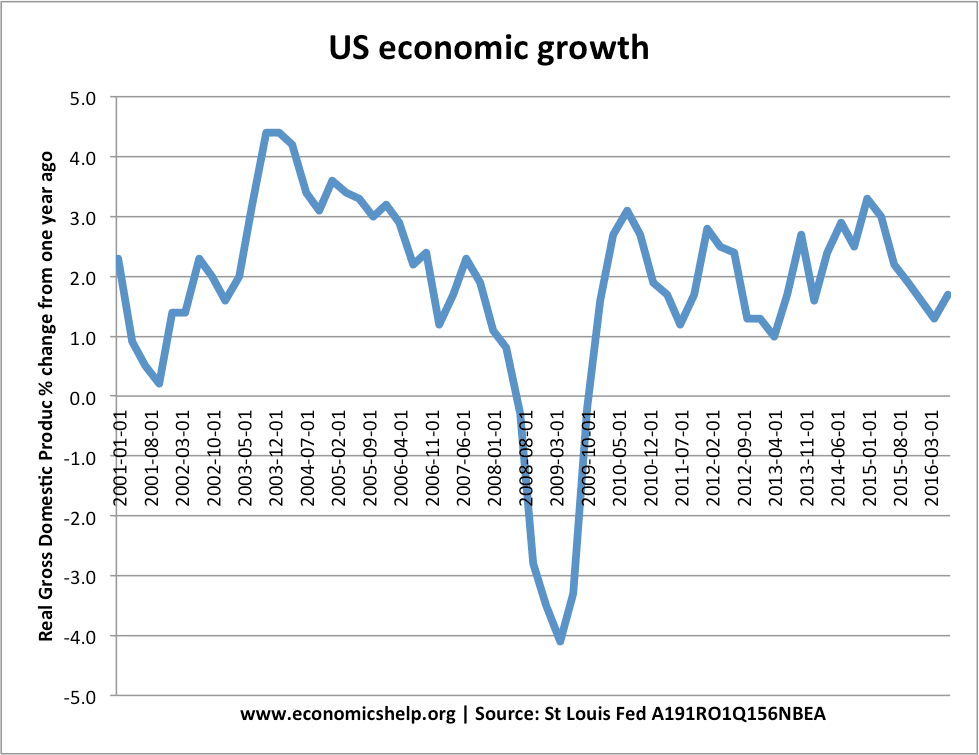

Kenneth Rogoff, an expert in financial crises, highlights that while some investors in commercial real estate will suffer severe equity losses, the probability of a full-blown financial crisis is limited due to the overall resilience of the global economy. However, the interconnectedness of real estate failures with the banking sector suggests that economic impact could be more widespread. If regional banks, which largely depend on commercial loans, face significant delinquencies, it may lead to forced consolidations or a tightening of lending standards. Thus, while there is no direct comparison to the 2008 crisis, the potential for a ‘slow-moving train wreck’ in the commercial real estate sector remains a concern.

Impact of High Office Vacancy Rates on the Economy

The surge in office vacancy rates since the pandemic has been a pivotal factor influencing the commercial real estate market and, by extension, the wider economy. Many businesses have shifted to remote or hybrid working models, drastically reducing the demand for downtown office space. This trend not only depresses commercial property values but also affects local economies dependent on the business activities that thriving office environments typically support. The economic impact is especially pronounced in urban areas, where high vacancy rates correlate with job losses in ancillary services reliant on office worker patronage, leading to reduced local consumption and economic stagnation.

Moreover, as vacancy rates remain elevated, the ongoing challenges for commercial real estate could spill over into other economic sectors. Consumers may face tighter lending conditions as regional banks, which have significant exposure to commercial real estate loans, deal with mounting pressure from delinquent debts. Financial stability concerns could lead banks to tighten lending standards overall, which would affect consumer credit availability and spending. Addresses these dynamics is crucial, as a failure to respond could exacerbate the economic pain felt in affected communities and stall recovery in areas struggling with high vacancy rates.

Regional Banks at Risk: A Looming Challenge

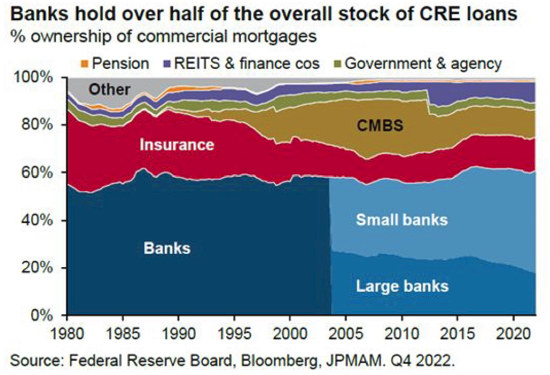

Regional banks are particularly vulnerable in the current commercial real estate landscape, with many having heavily invested in real estate loans during a period of low interest rates. As these loans come due, the combination of rising interest rates and declining property values threatens the financial health of these institutions. Smaller banks, which often face less stringent capital requirements compared to their larger counterparts, may not possess the resilience needed to withstand potential waves of delinquent loans. This situation poses a significant risk to local economies reliant on community banking for lending and support.

The inefficiencies of the regional banking sector can intensify the economic impact of the commercial real estate crisis. If several regional banks experience notable losses or even face failure due to rising delinquency rates, the repercussions could resonate throughout the local economy. Tighter lending conditions could arise, limiting access to credit for consumers and small businesses, potentially leading to reduced economic activity in the surrounding areas. As a cautious observer of these developments, it’s crucial to advocate for strategic measures that ensure both the stability of smaller banks and the broader economic recovery.

The Role of the Federal Reserve in Mitigating Risks

The Federal Reserve’s response to rising concerns over commercial real estate loans and the resultant pressures on banks will be critical in shaping financial stability. As Kenneth Rogoff notes, the Fed has the capacity to intervene should regional banks face significant distress similar to previous crises, but the current situation does not mirror the financial collapse of 2008. Nevertheless, the Fed’s hesitation to reduce interest rates amid a still-solid economy raises questions about its strategy moving forward. Lowering rates could help ease refinancing pressures for borrowers with maturing loans, but it may also invite renewed risks to inflation and overall economic health.

In addressing the commercial real estate crisis, the Federal Reserve must balance the need for monetary policy flexibility with the potential repercussions for the banking sector and economic stability. Effective communication regarding its policy direction and intentions can help stabilize market expectations and potentially avert panic as issues arise. Moreover, the Fed’s ability to monitor risk in the banking system as it relates to real estate loans will be essential. As banks navigate these pressures, clear guidelines and support from the central bank could be the difference between a manageable downturn and a more profound economic crisis.

The Future of Commercial Real Estate: An Uncertain Path

The future of commercial real estate appears uncertain as various factors continue to shape market dynamics. Decreased demand for office space, compounded by transitional post-pandemic work habits, creates a labyrinth of challenges. Property owners, investors, and banks are grappling with the ramifications of over-leveraging while attempting to navigate a changing economic landscape. Without adaptive strategies and innovative redevelopment plans, many firms may find themselves beset by depreciating asset values and a shrinking market, which could trigger a cascade of failures in commercial real estate.

Conversely, there are opportunities for revitalization within the commercial real estate sector. The differentiation between types of properties indicates that super-premium buildings equipped with modern amenities are still in demand. By focusing on redevelopment efforts that align with emerging work trends and housing shortages, stakeholders may find paths forward that mitigate losses and harness new growth avenues. Partnerships between private investors, public entities, and community stakeholders will be pivotal in guiding the evolution of real estate portfolios tailored to new economic realities.

Pension Funds and Their Exposure to Real Estate Risks

Pension funds represent a significant portion of the investors in commercial real estate, leading to heightened scrutiny of their exposure to emerging risks posed by high vacancy rates and declining property values. The fallout from potential losses in real estate portfolios could directly affect the retirement savings of countless individuals. While pension funds are diversified in many ways, the concentration of investments within the commercial real estate sector raises concerns about their vulnerability as the market faces unprecedented challenges. This adds a layer of complexity and risk for beneficiaries who depend on these funds for their future financial stability.

The economic implications of possible downturns in real estate investments for pension funds extend to the broader financial landscape. A substantial loss in value within these funds could lead to increased calls for policy measures aimed at protecting beneficiaries. Should pension funds experience marked reductions in returns due to the unfolding commercial real estate crisis, the ripple effects are likely to be felt by both the financial markets and the consumers dependent on these pensions for their livelihoods. Regulatory bodies must be vigilant in monitoring this exposure to ensure that the broader economic impact on financial stability is mitigated.

Adapting to a Post-Pandemic Real Estate Market

The commercial real estate sector faces unique challenges as it adapts to a post-pandemic market characterized by changing work habits and preferences. With many companies embracing remote or hybrid working models, the traditional demand for office space has substantially declined. This paradigm shift necessitates a reevaluation of existing strategies by property owners and stakeholders. The focus should pivot towards understanding how to repurpose or redevelop unoccupied commercial spaces and align them with evolving consumer preferences, specifically in regard to residential and mixed-use developments to address housing shortages.

Developing adaptive reuse projects that transform empty office buildings into residential units could potentially inject vibrancy back into certain urban areas, though challenges remain. Zoning restrictions, engineering complications, and market dynamics could hinder quick transitions to new property uses. Nevertheless, identifying creative opportunities for adaptation offers a necessary lifeline for many stakeholders caught in the downturn of commercial real estate. By embracing innovative solutions and adaptive strategies, the commercial real estate sector can navigate the complexities imposed by the new economic reality and foster long-term recovery and growth.

Consumer Behavior Amid Economic Pressures

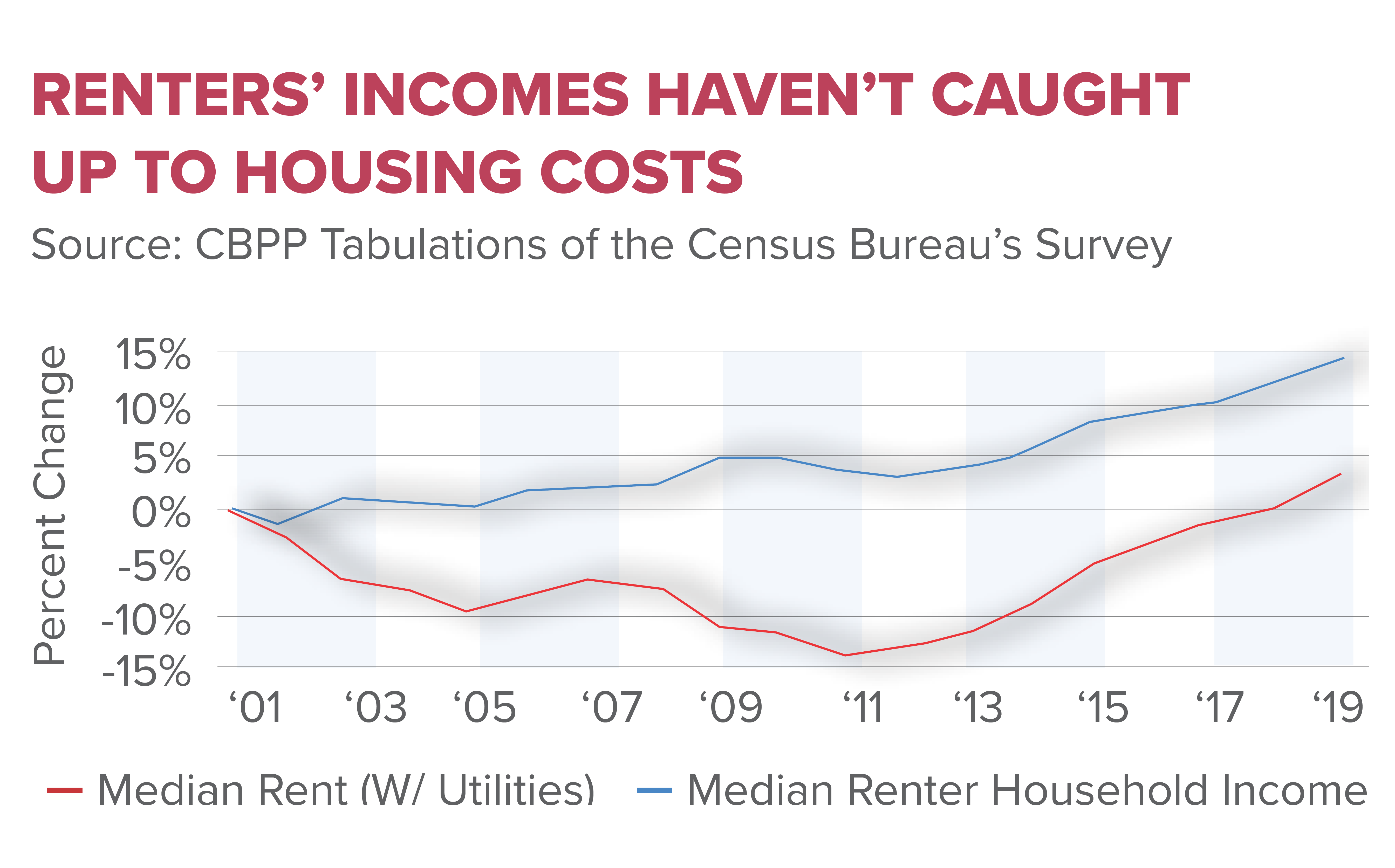

Consumer behavior is likely to be heavily influenced by the ongoing commercial real estate crisis. As economic pressures mount, particularly in regions heavily impacted by declining property values and weakening job markets, consumer confidence may wane. This situation can lead to tightened spending habits, creating a feedback loop that further exacerbates challenges in regional economies. The interplay of high office vacancy rates and the potential for restrained credit access could stifle consumer spending and dampen economic recovery in the short term.

However, there is nuance to consider with consumer behavior; while some may experience financial strain due to potential layoffs or reduced job security, others may benefit from the robust performance of unrelated sectors, such as technology or healthcare. These contrasting experiences contribute to varied perceptions of economic health among consumers. Engaging strategies aimed at bolstering consumer confidence can play a crucial role in mitigating adverse effects and promoting economic stability during this tumultuous period. Ensuring open communication from businesses and policymakers can reassure consumers and foster a more resilient economic environment.

Strategic Recommendations for Real Estate Recovery

In light of the commercial real estate crisis, strategic recommendations for recovery are essential for stakeholders involved in the real estate market. A proactive approach would encourage property owners and investors to pursue diversification strategies within their portfolios to mitigate risks from heavy reliance on commercial properties. Engaging alternative investment strategies, such as incorporating mixed-use developments or socially responsible investing, could offer an opportunity for stability amid changing market conditions. Moreover, fostering partnerships with local governments and community organizations may aid the transition to new developments that better align with public needs.

Additionally, the implementation of market-responsive practices can drive recovery within the sector. Incorporating innovative technologies and sustainability initiatives into building designs can attract tenants even in the face of high vacancy rates. As the market evolves, staying agile in responding to consumer preferences and economic changes is critical. Emphasizing adaptability and resilience will be vital for navigating the complexities of the commercial real estate landscape and ensuring a sustainable future for investors and communities alike.

Frequently Asked Questions

How are high office vacancy rates contributing to the commercial real estate crisis?

High office vacancy rates are significantly impacting the commercial real estate crisis by depressing property values in major cities. A drop in demand for office space, particularly since the pandemic, has led to vacancy rates soaring between 12 to 23 percent. This oversupply not only reduces rental income for property owners but also jeopardizes the value of real estate loans, which are critical assets on banks’ balance sheets.

What impact does the commercial real estate crisis have on banking sector risks?

The commercial real estate crisis increases banking sector risks as many banks hold substantial amounts of real estate loans. With a large portion of commercial mortgage debt coming due, regional banks, in particular, could face insolvency if borrowers default on these loans. This scenario may lead to significant financial instability within the banking system, especially among smaller banks with higher exposure to commercial property.

What economic impacts arise from the commercial real estate crisis?

The economic impacts of the commercial real estate crisis include potential job losses in construction and related industries, reduced consumer spending due to lower property values, and tighter lending conditions. If significant delinquencies among commercial real estate loans become widespread, it could trigger negative spillover effects throughout the economy, undermining financial stability and growth.

Are commercial real estate loans at risk of delinquency affecting financial stability?

Yes, the risk of delinquency on commercial real estate loans poses a threat to financial stability. As large amounts of commercial mortgage debt mature, banks may face increased defaults, particularly if the economy slows down significantly. This could lead to a cycle of tighter credit and reduced economic activity, intensifying the commercial real estate crisis.

What strategies can mitigate the risks associated with the commercial real estate crisis?

To mitigate risks from the commercial real estate crisis, stakeholders might consider restructuring distressed loans, enhancing regulatory measures for banks, and exploring new uses for vacant commercial spaces. Additionally, policies aimed at stabilizing interest rates could provide some relief to borrowers looking to refinance, thereby lessening the potential fallout for financial institutions.

How does the Federal Reserve’s interest rate policy affect the commercial real estate crisis?

The Federal Reserve’s interest rate policy has a direct effect on the commercial real estate crisis. Higher interest rates can exacerbate the crisis by increasing borrowing costs for real estate loans, making it more challenging for investors to refinance maturing debt. Without lower long-term interest rates, property values may continue to decline, increasing the risk of defaults and further destabilizing financial markets.

What role do pension funds play in the commercial real estate crisis?

Pension funds are significant investors in commercial real estate and are likely to face exposure to losses from the current downturn. As property values decrease and rental incomes fall, pension funds may experience reduced returns, which could impact their ability to meet future obligations to beneficiaries. This interconnectedness illustrates how the commercial real estate crisis can affect broader financial systems and ultimately consumers.

| Key Topic | Details |

|---|---|

| Commercial Real Estate Crisis | High office-vacancy rates currently range from 12% to 23% in major U.S. cities, impacting property values and causing concerns about bank stability and potential widespread losses. |

| Surge in Loans | 20% of the $4.7 trillion in commercial mortgage debt is due this year, raising alarms about bank liquidity and potential defaults. |

| Impact on Banks | Large banks are more resilient due to strict regulations post-2008, but regional banks, which are more exposed to commercial real estate, may face severe repercussions. |

| Predictions and Effects | While some believe there’s a recovery on the horizon, others anticipate a series of bankruptcies leading to a ‘slow-moving train wreck’ in commercial real estate. |

| Consumer Impact | Potential losses in pensions and financial markets may affect consumer spending, but the overall economy remains stable for now. |

| Comparison to 2008 | While concerning, the current situation is viewed as less acute than the 2008 financial crisis due to different underlying economic conditions. |

Summary

The commercial real estate crisis poses significant challenges as high office-vacancy rates impact property values and risk the stability of banks heavily invested in real estate loans. With a substantial portion of commercial mortgage debt maturing, concerns arise over potential bank failures, especially among regional banks with fewer regulations. The interplay between declining demand for office space due to shifting work patterns and the specter of significant financial losses creates a precarious situation. Despite these issues, experts suggest that the overall economy remains robust, though a significant recession could exacerbate the challenges ahead. It’s a scenario that calls for careful monitoring and preparedness to avoid a repeat of past financial crises.