Can Trump fire Fed Chairman Jerome Powell? This question has lingered amid the tumultuous relationship between former President Trump and the Federal Reserve Chair. As Trump navigated economic policies that often clashed with Powell’s approach to interest rates, speculation about a potential ousting grew, leading to significant market reactions. Trump’s accusing remarks over Powell’s perceived inaction on interest rates reflected deeper concerns about the Federal Reserve’s independence and its critical role in stabilizing the economy. Ultimately, this tension illuminated the delicate balance between presidential influence and the need for a central bank that operates free of political pressure.

The authority of a president to dismiss the head of the nation’s central banking system has sparked widespread debate, particularly in the context of the Trump-Powell dynamic. This intrigue into the potential firing of the Federal Reserve Chairman raises vital questions about monetary policy governance and the autonomy of key financial institutions. With Trump’s economic agenda often at odds with Powell’s cautious approach to interest rate adjustments, the implications of such a move could have profound consequences for market confidence and fiscal stability. Coupled with the critical nature of Federal Reserve independence, this discussion reflects broader concerns about the preservation of robust economic leadership amidst political pressures. Understanding the intricacies of this relationship is essential for grasping the potential impact of presidential actions on the economy.

Understanding Trump’s Authority to Fire the Fed Chairman

The question of whether President Trump can fire Federal Reserve Chairman Jerome Powell is complex. It intertwines statutory interpretations of the Federal Reserve Act and broader questions of executive power. The original Act provided a framework for the removal of governors, yet it remains ambiguous whether the four-year term of the chair includes the same ‘for cause’ protections as other members of the Board of Governors. This uncertainty raises critical legal questions; will the courts uphold the independence of the Federal Reserve or lean towards the President’s authority to remove the chairman?

Given the historical precedent, many legal scholars point to the landmark 1935 Supreme Court ruling in Humphrey’s Executor, which upheld the idea that independent agency heads could only be removed for cause. However, recent decisions suggest a potential shift in how the Supreme Court might view such protections. As we analyze the current composition of the Supreme Court, especially the leanings of conservative justices, there is a growing sentiment that they may consider the Federal Reserve distinct from other independent agencies. This opens a pathway for increased executive power that could enable a president, like Trump, to restructure the central bank, should he choose to pursue that course.

Impact of Trump’s Policies on the Federal Reserve’s Independence

The relationship between President Trump and Chairman Powell has been notably strained, particularly regarding monetary policy. Trump has strongly advocated for lower interest rates, arguing that an aggressive stance could inject necessary vitality into the economy. Conversely, Powell’s more cautious approach emphasizes long-term stability and targets inflation around two percent. This fundamental clash showcases the tension between Trump’s economic policies and the Fed’s mandate for insulation from political pressures, thereby raising concerns about the fundamental independence of the Federal Reserve.

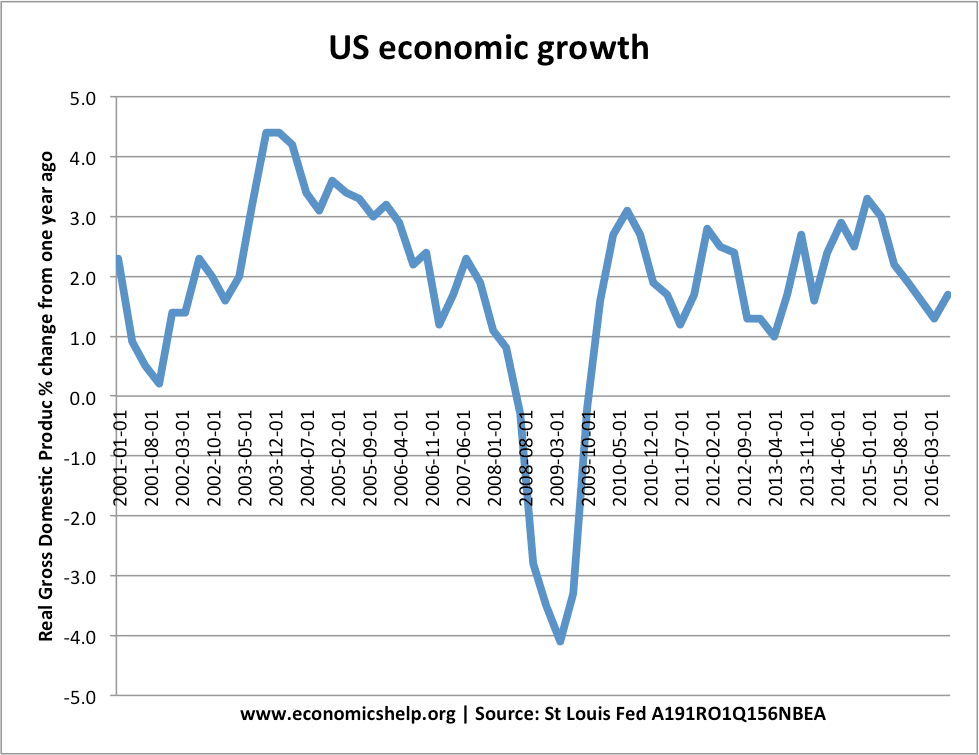

Market reactions to these tensions can be dramatic. For instance, Trump’s tariff announcements previously roiled markets, highlighting the direct impact political decisions can have on economic stability. If a president were to threaten the firing of a Fed chair, like Powell, the market might react negatively, anticipating shifts towards looser monetary policy that could ignite inflation concerns. Hence, the broader economic landscape becomes precarious, as Wall Street fears that undermining the Fed’s independence could lead to instability, higher rates, and decreased confidence in the president’s economic strategy.

Evaluating Trump’s economic policies reveals an ongoing conflict; his push for quicker economic growth often contradicts the cautious approach advocated by the Fed. Markets tend to prefer a stable, predictable monetary policy that minimizes surprises, and Trump’s rhetoric can provoke uncertainty. Hence, maintaining a healthy Fed—especially with potentially disruptive changes in leadership—becomes essential in sustaining market confidence and economic predictability.

The Federal Reserve’s Role in Economic Policy

The Federal Reserve plays a crucial role in shaping economic policy through its control over interest rates and monetary supply. Jerome Powell, as the chairman, influences these decisions significantly, though he operates within a collaborative framework with other board members. This response to the economic environment is inherently tied to the Fed’s overarching goal: to promote maximum employment while stabilizing prices. Understanding this goal is essential, especially as political forces seek to exert influence over monetary policy.

Trump’s administration has put additional pressure on the Federal Reserve to adjust interest rates more aggressively to stimulate growth. However, Powell has emphasized the need for a balanced approach that considers the risks of inflation and potential market instability. The challenge lies in keeping the Fed’s independence intact; any perceived political meddling could provoke market fears, leading to increased volatility. Thus the Federal Reserve’s efficacy hinges on its ability to navigate these pressures while maintaining public and market confidence.

Market Perception of Powell’s Tenure

Market participants closely watch Jerome Powell’s policies and any potential changes in leadership at the Fed. If Powell were to be removed, the identity of his successor would be scrutinized as it could signal shifts in monetary approach. Investors generally react negatively to the uncertainty surrounding monetary policy, as it correlates directly with their investment strategies and confidence in economic growth. The act of dismissal, regardless of rationale, could trigger widespread selling and instability in financial markets.

When it comes to succession planning, the potential appointee to replace Powell is also of interest. However, if the termination of Powell was viewed as a move toward a more lenient monetary policy, the implications could reverberate far beyond individual appointments. Price stability and inflation control are paramount for investor confidence, and any action perceived to undermine the Fed’s independence could erode that trust, thus leading to higher interest rates across the board. Maintaining a harmonious relationship between the administration and the Fed becomes crucial in mitigating risks associated with sudden changes in leadership.

Legal Perspectives on Removing a Fed Chairman

The legal grounds for a president to remove a Federal Reserve Chairman are currently under scrutiny amid various judicial interpretations. Historically, the Federal Reserve Act’s delineation of powers and protection against arbitrary removals has been relied upon to preserve its independence. However, the evolving landscape of Supreme Court rulings, particularly in relation to executive authority, raises questions about the fundamental balance of power. A potential challenge to Powell’s position could lead the Court to re-evaluate long-standing precedents regarding ‘for cause’ removal protections.

For instance, the recent Seila Law decision casts doubt on the constitutionality of ‘for cause’ protection specifically for agencies like the Consumer Financial Protection Bureau. This judicial momentum suggests a potential precedent whereby the independence of the Federal Reserve could be similarly challenged, reflecting a broader interpretation of executive authority. The ramifications of such a judicial stance could fundamentally reshape the checks and balances regarding the President’s power to influence central bank operations, further complicating the Fed’s role in executing effective monetary policy.

The Consequences of Political Pressure on Interest Rates

Interest rates are a crucial aspect of the Federal Reserve’s toolkit in managing economic growth and controlling inflation. Political pressure, particularly from a president like Trump, who advocates for lower rates, can create tension within the Fed’s decision-making structure. If the Fed responds to political pressures rather than economic indicators, it risks destabilizing the economy by either stoking inflation or undermining long-term growth prospects.

The implications extend to market behavior as well; whenever there is an indication of political interference in interest rate decisions, markets can exhibit volatility. Investors forecast higher risk premiums if they sense that the Fed’s actions are being swayed by external political agendas, which can lead to unfavorable economic conditions. Therefore, the dynamics of interest rate policies versus demands from presidential agendas underscore the delicate balance that the Federal Reserve must navigate to maintain its credibility and effectiveness.

Assessing the Future of Fed Chair Succession Planning

The question of succession planning for the Federal Reserve Chair offers a glimpse into the future mechanics of monetary policy. If President Trump were to remove Jerome Powell, the search for a successor would prompt intense scrutiny from both the public and market participants. The newly appointed chair must be capable of navigating the fine line between executing prudent monetary policy and satisfying political pressures. This dual expectation could significantly affect the continuity of the Fed’s operations and its approach to managing economic challenges.

Ultimately, the identity of a new chair could either calm or further rattle market dynamics. Should the successor reflect a more extreme approach towards monetary policy, markets may react negatively, fearing destabilizing measures similar to what Trump advocates. Conversely, a well- regarded successor with a reputation for maintaining Fed independence could re-establish market confidence. Thus, the implications of removing Powell extend far beyond the individual chairmanship; they redefine the Fed’s role amidst political discourse and economic management.

Public Opinion and its Influence on Fed Decisions

Public opinion plays an increasingly significant role in shaping perceptions of Federal Reserve actions, particularly in turbulent political climates. As President Trump openly criticizes Powell and the Fed for not lowering rates aggressively, public sentiment can sway market expectations. When everyday citizens and investors witness political leaders openly challenging the independence of the central bank, it can lead to diminished trust in the institution’s ability to safeguard economic stability.

In this context, the Federal Reserve must maintain transparency and communicate effectively with the public to safeguard its independence. Failure to do so could provoke a public outcry against perceived politicization, leading to a loss of credibility among both consumers and investors. Hence, the twin challenges of public relations and monetary policy formulation are critical, as they underpin the legitimacy of the Fed amidst unprecedented political influences.

The Future of Federal Reserve Independence

Looking into the future of Federal Reserve independence amidst contentious political landscapes, it remains imperative for the institution to uphold its core mandate of economic stability. The potential for political leaders to influence monetary policy continues to loom over the Fed, as exemplified in the contentious relationship between Trump and Powell. The balance of power must be preserved to ensure that monetary decisions are driven by economic data rather than political whims, which can have lasting ramifications for inflation and employment.

The Fed’s trajectory will ultimately depend on the legal interpretations surrounding its independence. Should the courts endorse a broader view of executive power over independent agencies, it could reshape the landscape of U.S. monetary policy significantly. Thus, the resilience of the Federal Reserve in safeguarding its independence while fulfilling its economic objectives is critical in steering the nation toward sustainable growth and stability.

Frequently Asked Questions

Can Trump fire Fed Chairman Jerome Powell?

While President Trump has expressed frustration with Fed Chairman Jerome Powell, actually firing him is complex. The Federal Reserve Act allows removal for cause, but whether this applies to the chair is debated. Many experts suggest that such a move could violate the Fed’s independence, which is vital for maintaining market trust.

What is the relationship between Trump and Powell concerning interest rates?

Trump has criticized Powell for not lowering interest rates aggressively enough, believing that a looser monetary policy would benefit economic growth. This tension highlights the broader debate on Federal Reserve independence versus political influence in setting interest rates.

How does the market react to the possibility of Trump firing Powell?

The markets are likely to react negatively to any news of Trump’s intent to fire Powell. Analysts warn that such a move could undermine the credibility of the Federal Reserve and raise long-term interest rates, which would affect investment and economic stability.

What are the implications of Trump’s economic policies on the Federal Reserve?

Trump’s economic policies, especially his tariffs and trade restrictions, have raised concerns about inflation and economic growth. His confrontational stance toward Powell and the Fed’s monetary policies suggest a desire for more control, which critics argue could jeopardize the Fed’s long-standing independence.

Why is Federal Reserve independence important in the context of Trump’s presidency?

Federal Reserve independence is crucial because it allows central bankers to make decisions based on economic data rather than political pressures, maintaining credibility. Trump’s attempts to influence this independence could lead to instability in financial markets, as investors seek certainty regarding interest rates and inflation.

Is there a legal basis for Trump to remove Powell before his term ends?

The legal framework regarding Trump’s ability to remove Powell involves interpretations of the Federal Reserve Act. The 1970s amendment complicates the issue of ‘for cause’ removal. While some argue that current Supreme Court trends may lean towards presidential authority over independent agencies, there remains significant legal ambiguity.

What would happen if Trump appoints a successor to Jerome Powell?

The appointment of a successor to Powell could help assuage market fears, but the act of removing him, regardless of the successor’s credentials, could signal a shift toward a more accommodative monetary policy. Markets typically react more to the action of removal than the identity of the appointee.

How does the Fed’s independence protect against Trump’s policies?

The Fed’s independence acts as a safeguard against political influences that prioritize short-term economic gains over long-term stability. This separation helps maintain lower and more stable inflation rates, crucial for investor confidence, even amid pressure from a sitting president like Trump.

What factors could influence a potential change in the Fed chair during Trump’s administration?

Factors include Trump’s political considerations, the state of the economy, market reactions to interest rate changes, and potential shifts in Supreme Court interpretations regarding executive authority over independent agencies like the Federal Reserve.

What is the overall economic impact of Trump’s criticisms of Powell and the Fed?

Trump’s public criticisms of Powell could lead to increased volatility in the financial markets. If investors perceive threats to the Fed’s independence, they could react by altering investment strategies, contributing to rising interest rates and potential economic instability.

| Key Point | Details |

|---|---|

| Possibility of Ousting Powell | Legal ambiguity exists over whether Trump can fire Fed Chairman, Jerome Powell, with interpretations of the Federal Reserve Act affecting this possibility. |

| Market Reaction | Financial markets are unsettled by the prospect of Powell being fired as it may lead to a less independent Fed and potential inflation risks. |

| Legal Framework | The Federal Reserve Act allows for the removal of governors for cause, but it does not explicitly outline provisions for the Fed Chair. |

| Supreme Court’s Role | The Supreme Court’s interpretation of executive power in independent agencies could influence Trump’s ability to remove Powell. |

| Impact on Monetary Policy | Any attempt to remove Powell may lead to market instability, affecting long-term interest rates and undermining the Fed’s credibility. |

Summary

Can Trump fire Fed Chairman Jerome Powell? While it’s theoretically possible, both legal interpretations and potential market fallout make such a decision fraught with challenges. The Federal Reserve’s independence is critical to maintaining economic stability, and analysts suggest that an attempt by President Trump to oust Powell could significantly destabilize markets, jeopardizing long-term monetary policy and credibility. As history has shown, the dynamics between the presidency and the Fed are delicate, and understanding these nuances is essential for both policymakers and the public.